How to Withdraw From EPF Account 3

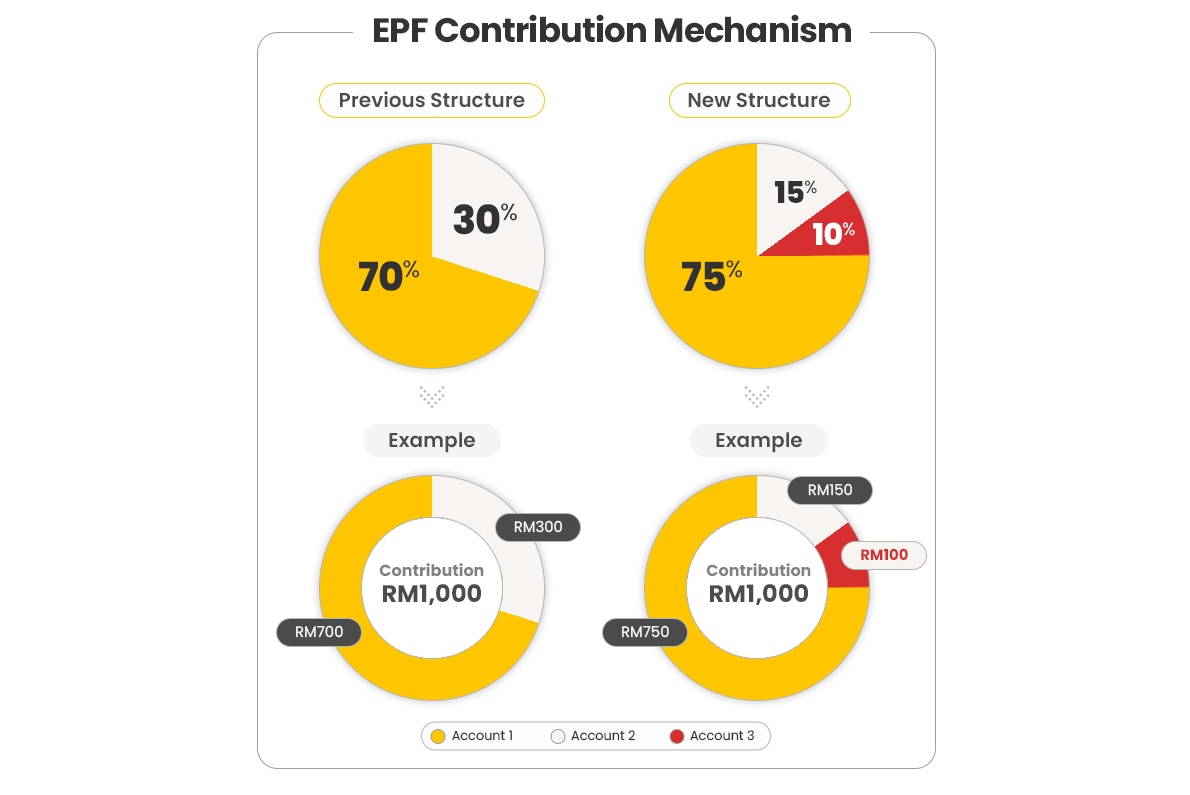

As you may be aware, the Employees Provident Fund (EPF) restructured its accounts in 2024. Now, members under the age of 55 will automatically have an Account 3 (Fleksibel). The new distribution is 75% for Account 1 (Persaraan), 15% for Account 2 (Sejahtera), and 10% for Account 3 (Fleksibel), as the image above illustrates.

EPF Account 3 is designed to help members manage short-term financial challenges, allowing them to focus on long-term planning. Let’s take a look at how you can go about withdrawing funds from your Account 3 and possibly putting it to good use.

One-time transfer to Account 3 (NO LONGER AVAILABLE)

Account 3 will start with a balance of RM0, requiring time to accumulate savings. However, members could make a one-time transfer from Account 2 to Account 3 between 12 May 2024 and 31 August 2024, allowing immediate withdrawals.

This initial amount transfer is no longer available from 1 September 2024 onwards.

Withdrawal process

Important points to note before withdrawing

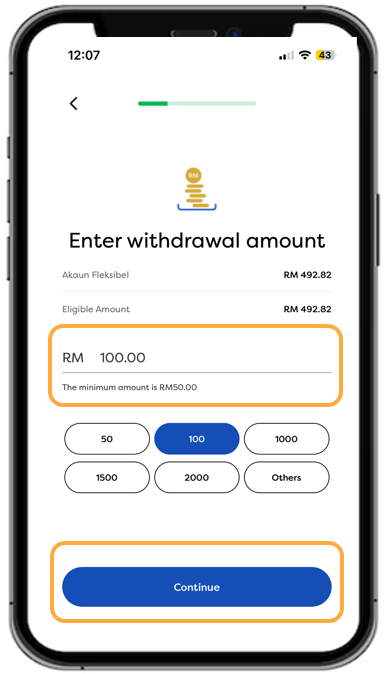

- Minimum withdrawal: RM50.

- You can withdraw online using the KWSP i-Akaun app.

- Maximum withdrawal: Unlimited, but withdrawals over RM250 require eKYC if done online. If eKYC cannot be completed, visit an EPF office or Self-Service Terminal (SST) for thumbprint verification.

- Daily limit: One withdrawal per day.

Steps to withdraw from Account 3 (Fleksibel)

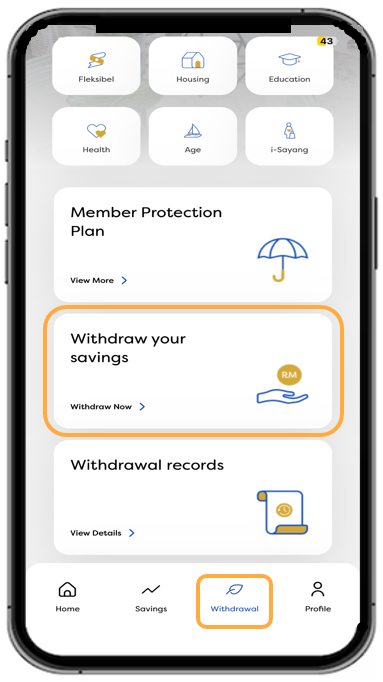

- Log in to your KWSP i-Akaun app.

- Click on ‘Withdrawal’ at the bottom and select ‘Withdraw your savings’.

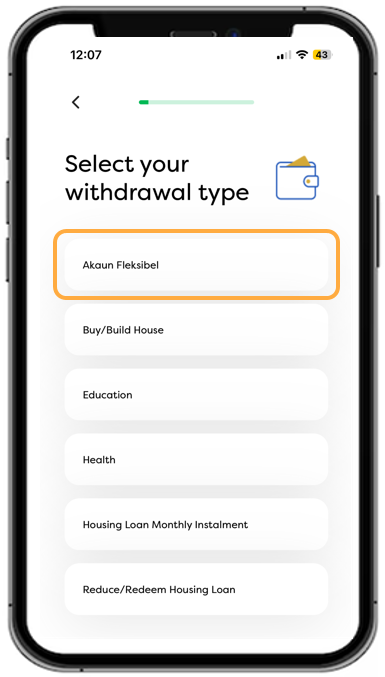

- Choose ‘Akaun Flexible’ and click ‘Withdraw Savings’ in the next screen.

- Enter the withdrawal amount and click ‘Continue’.

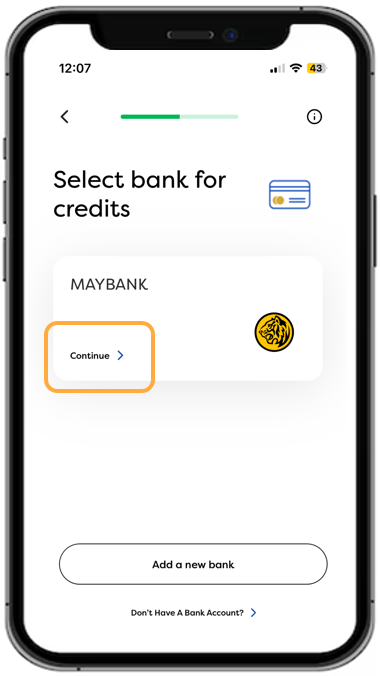

- Provide or update your bank account details (must be under your name) and click ‘Continue’.

- Read and accept the Members Declaration.

- Enter the TAC number for confirmation. A successful application confirmation page will appear.

Withdrawal limits and eKYC

Withdrawals from Account 3 are for members below 55 with sufficient savings in the account. You can withdraw any amount above RM50 without needing supporting documents, but an active bank account is recommended for smooth processing.

For identity verification, members don’t need to be physically present at EPF offices if the withdrawal amount doesn’t exceed RM30,000 and their previous withdrawal history does not have any red flags.

If members do not have a previous withdrawal history or if their bank account information varies from previous withdrawals, identity verification will be required and can be done via:

- Thumbprint verification at any EPF office SST for amounts over RM10,000, or

- Online verification for amounts under RM10,000.

Withdrawal timeline

Upon approval, EPF members with sufficient funds in Account 3 can expect their payment within 7 working days.

Can funds be transferred between EPF accounts?

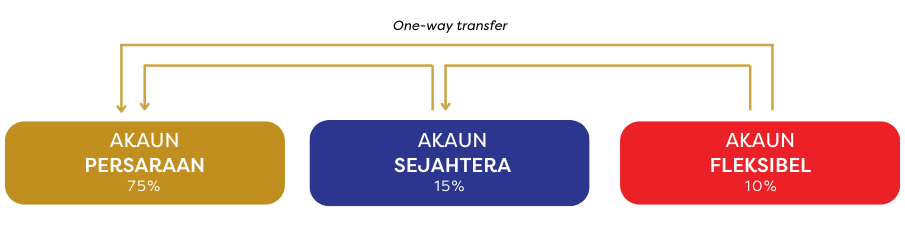

Members are allowed to transfer their savings between specific EPF accounts under the following conditions:

- From Account 3 (Fleksibel) to Account 2 (Sejahtera)

- From Account 3 (Fleksibel) to Account 1 (Persaraan)

- From Account 2 (Sejahtera) to Account 1 (Persaraan)

Refer to the illustration below provided by the EPF for a clear understanding of these transfer pathways.

Important Note: Once savings are transferred, the process is irreversible, and funds cannot be moved back to the original account. Transfers from Account 1 (Persaraan) to Account 2 (Sejahtera) or Account 3 (Fleksibel) are strictly prohibited, as Account 1 (Persaraan) is dedicated to retirement savings.

What you can do with the funds

Being prudent and responsible with spending is crucial in becoming financially stable in today’s world. If you have withdrawn funds from Account 3, try to use the money for only pressing matters or invest in profitable financial facilities.

💡 The information provided above is purely for educational purposes.

References

1. EPF (2024). “EPF Account Restructuring Initiative”. https://www.kwsp.gov.my/account-restructuring

You may also like

By

By