Smart Income, the all-in-one Shariah-compliant plan that helps you achieve financial independence with guaranteed cash payments and adequate levels of protection.

RETIREMENT

SMART INCOME

All-in-one Shariah-compliant retirement, protection & savings plan

Why choose Smart Income?

Achieving financial independence during your retirement years is a vital milestone. To enjoy a more comfortable and fulfilling lifestyle during your retirement, Smart Income is a takaful plan designed to secure your protection needs in addition to providing you with an annual income stream, in the form of Annual Cash Payment as well as a maturity benefit in the form of 115% of the sum covered and amount in Participant’s Investment Fund.

Sign up to:

- Complement your wealth for your dream retirement

- Provide support and financial security for you and your loved ones

- Set aside sufficient funds for unforeseen and unplanned expenses

- Cushion against financial shocks

No medical examination is required for plans with an initial Annual Cash Payment of up to RM66,000. For a limited time from 10 November 2023 - 9 February 2024, you stand to win luxury watches worth RM8,000 each when you sign up with a minimum of Annual First Year Contribution of RM30,000!1

1Terms and conditions apply.

Benefits of Smart Income

|

|

|

||

| Annual Cash Payment | Short Contribution Term | Maturity Benefit | ||

|

The amount increases by 20% of the initial amount starting from the 11th year until the age of 75 or 85.

|

Flexibility to choose your preferred payment term of 5 or 10 years.

|

Receive 115% of the sum covered and amount in Participant’s Investment Fund.

|

||

|

|

|

||

| Guaranteed Acceptance | Accidental Death Benefit: | Death Benefit | ||

|

Up to an initial Annual Cash Payment of RM66,000.

|

-Within Malaysia, Singapore and Brunei Additional 100% of the sum covered on top of the Death Benefit payable. -Overseas (Outside Malaysia, Singapore and Brunei) Additional 200%2 of the sum covered on top of the Death Benefit payable.

|

Receive one lump sum payment of 3 times the initial Annual Cash Payment and the Participant’s Investment Fund amount.

|

Note: 2Only covers up to 60 consecutive days per trip overseas. If the accident happens on the 61st day or later while overseas, an additional 100% instead of 200% sum covered shall be payable.

How does Annual Cash Payment work?

You can choose to receive your Annual Cash Payment with a minimum of RM5,000 starting from age 55 or 60. Your Annual Cash Payment will increase by 20% from the 11th year of your initial Annual Cash Payment until age 75 or 85.

For example, if you choose to start receiving your Annual Cash Payment (CP) from:

- a) age 55

Coverage Term till age 75

Coverage Term till age 85

% of initial CP opted

Age GCP is received

Age 55 - 64

Age 55- 64

100%

Age 65 - 75

Age 65 - 85

120%

Total no. of payments

21

31

b) age 60

Coverage Term till age 75

Coverage Term till age 85

% of initial CP opted

Age GCP is received

Age 60 - 69

Age 60 - 69

100%

Age 70 - 75

Age 70 - 85

120%

Total no. of payments

16

26

Note:

- Annual Cash Payment is an annual payment received by Participant from age 55 or 60.

- Age is subject to the Participant's age at the next birthday.

How does Smart Income work?

Here’s a scenario:

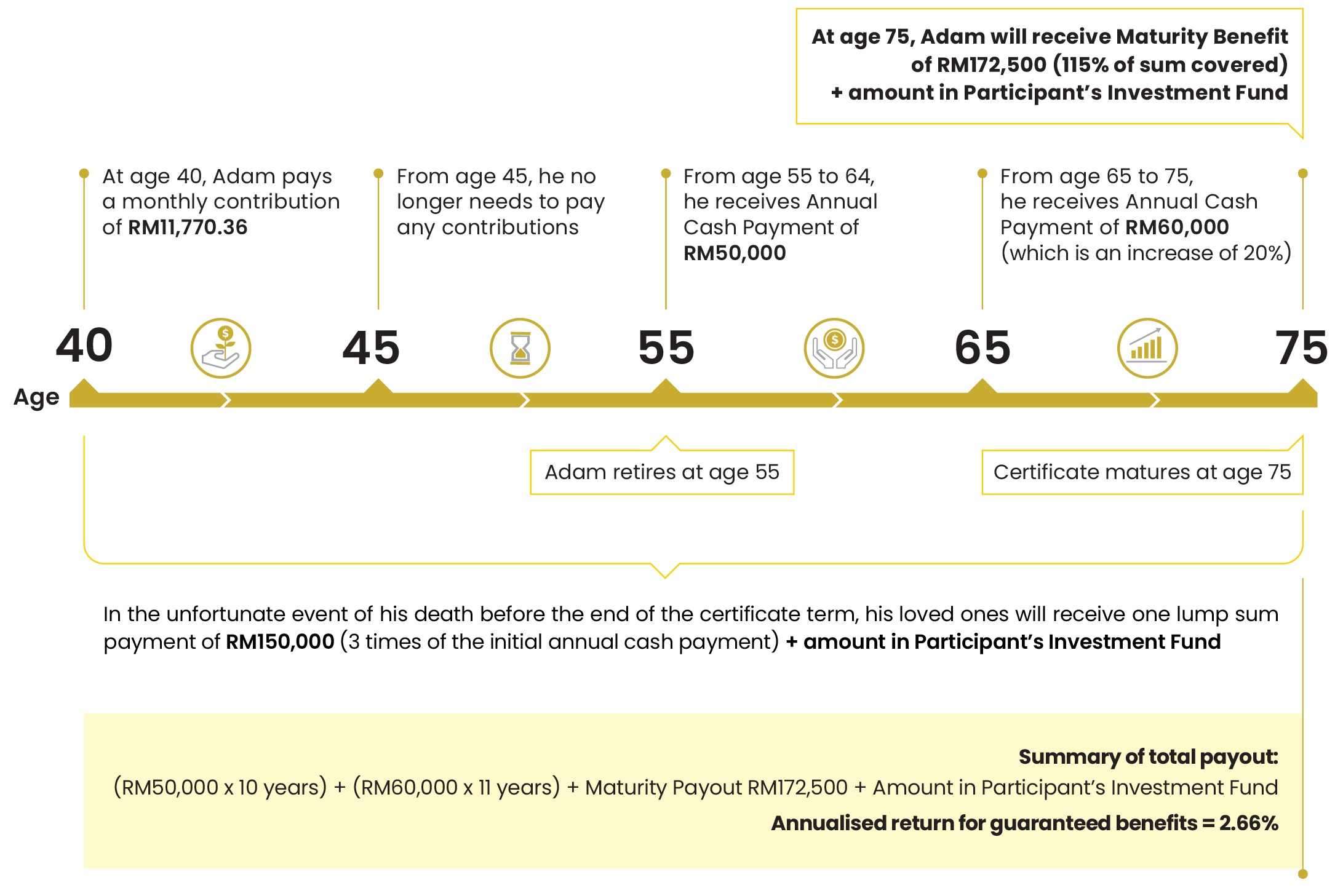

Adam, aged 40, is married with children. He aspires to retire at the age of 55 and aims to achieve additional annual income of RM50,000 upon retirement. Currently, he has RM3,000,000 in total assets and signs up for the Smart Income takaful plan, choosing a payment term of 5 years with an Annual Cash Payment of RM50,000 and the sum covered is RM150,000.

Note:

- The above is a scenario for a Guaranteed Acceptance case.

- This scenario is subject to the Participant's age at the next birthday.

- Person covered can opt to receive Annual Cash Payment starting from the end of certificate year of age 54 or 59.

- The contributions that you pay contribute to both the savings and protection elements of the product, e.g. Death Benefit. If you are looking for financial products with a savings element, you may wish to compare the annualised returns of this product with the effective returns of other investment alternatives.

- Terms and conditions apply.

Eligibility

- Guaranteed acceptance is up to initial Annual Cash Payment of RM66,000 for Malaysians, as well as for Singaporeans and Bruneians who are working/residing in Malaysia.

- Malaysians, Singaporeans and Bruneians are subjected to full underwriting if the initial Annual Cash Payment is above RM66,000.

- Foreigners subjected to foreigner’s risk guidelines.

How to Sign Up For/Purchase this Plan?

MAKE A BRANCH APPOINTMENT TODAY!

Talk to our friendly Marketing Representative at a Maybank branch near you.

Brochure & Product Disclosure Sheet

Click here to view flyer (ENG)

Click here to view flyer (BM)

Click here to view Product Disclosure Sheet (ENG)

Click here to view Product Disclosure Sheet (BM)

Customer rewards Campaign Terms and Conditions

PIDM protection

The benefit(s) payable under eligible certificate/product is(are) protected by PIDM up to limits. Please refer to PIDM’s TIPS Brochure or contact Etiqa Family Takaful Berhad or PIDM (visit www.pidm.gov.my).

Locate a Branch

Find a Maybank branch nearby to you

Orchestrate your wealth portfolio with an award-winning partner

Orchestrate your wealth with Maybank Premier & take up any participating solutions such as Investment, Insurance/Takaful, Home Financing & more to win exclusive prizes worth over RM230,000! T&C apply.

Campaign Period: 1 May 2024 - 31 August 2024

Redefine possibilities with Maybank Privilege

Plan your wealth & stand to win exclusive prizes worth over RM105,000 when you sign up for participating solutions – be it in Investment, Insurance/Takaful, Deposits or Home Financing. T&C apply

Campaign Period: 1 May 2024 - 31 August 2024