Are Property Insurance Costs Worth the Investment?

Homeownership is one of the most significant investments you can make in your lifetime, so taking steps to protect it is essential. Property insurance is one of the best ways to do this, but many homeowners wonder if it's worth the cost. The answer depends on the value of your property and the risks you face.

Fortunately, Malaysian homeowners have three types of property insurance policies to choose from, so you can find one that meets your needs and budget. Let’s dive into each one to understand the coverage they provide.

3 types of property insurance in malaysia

There are three primary types of property insurance policies available in Malaysia: fire insurance, homeowner policy, and home contents policy. Understanding these insurance options is essential for making informed decisions and ensuring the long-term security of your property.

Fire insurance

Fire insurance is the most basic property insurance coverage in Malaysia. It covers the value of the building structure but not its contents. It covers your property against losses or damages caused by fire, lightning, and explosion caused by domestic gas. However, fire insurance policies can be extended to cover other damages that might occur to the building, such as storms and floods.

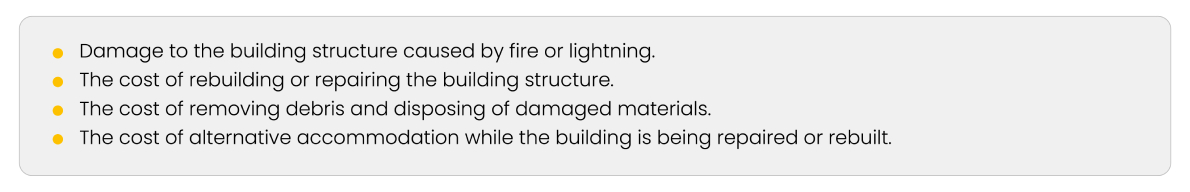

The basic fire insurance policy in Malaysia covers:

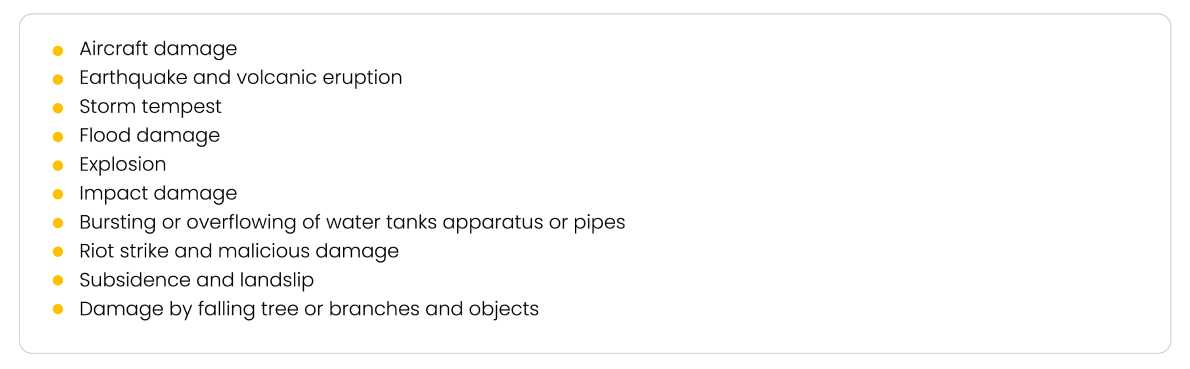

Depending on the insurance company, a fire insurance policy can also be extended to cover the following risks by paying an additional premium:

Typically, the building management for high-rise properties would have already purchased fire insurance for all units and you would not have to purchase it on your own. You’ll want to ensure that the amount is sufficient to cover the full value of your unit cost, including renovation and its contents. Simply retrieve a copy of the policy from building management and include it when you are preparing the relevant documents to process your loan with the bank.

Homeowner policy

The homeowner policy is a comprehensive property insurance policy that provides additional coverage beyond the basic fire insurance policy.

A homeowner policy property insurance coverage includes:

Physical structure of your home, including the walls, roof, fixtures, and outbuildings.

Damage caused by severe weather events, such as floods, hurricanes, typhoons, and windstorms.

Damage caused by burst pipes, theft, and vandalism.

Depending on the insurance company, an extended homeowner policy may also cover:

Loss of use coverage

This covers temporary housing and living expenses if your home is uninhabitable due to a covered event.

Personal liability coverage

This coverage protects you from financial liability if someone is injured on your property.

Medical payments coverage

This coverage pays for the medical expenses of anyone injured on your property, regardless of who is at fault.

Home contents policy

The home contents policy, which is also known as personal property insurance, provides additional coverage for the contents in your home if they are damaged by fire, theft, vandalism, or natural disasters.

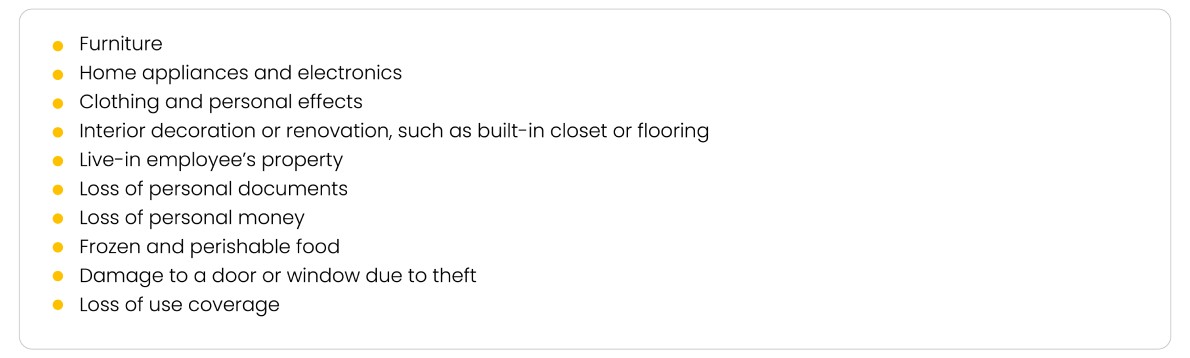

Home contents policy typically covers:

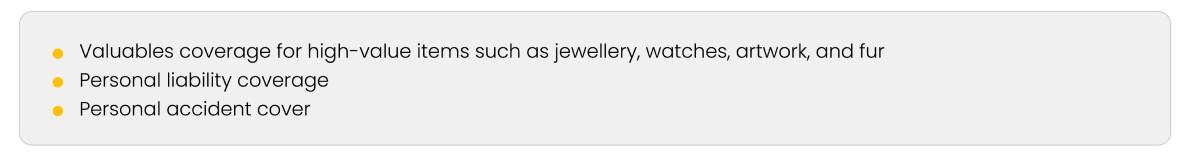

Depending on the insurance company, an extended homeowner policy may also cover:

Summary of property insurance in malaysia

Here’s a summary of the aforementioned three primary types of property insurance in Malaysia for comparison.

|

|

Fire insurance |

Homeowner policy |

Home contents policy |

|---|---|---|---|

|

Building structure damage caused by fire or lightning |

✓ |

✓ |

❌ |

|

Loss of use coverage |

✓ |

Extended policy |

✓ |

|

Building structure damage caused by aircraft, natural disasters, severe weather events, explosion, impact damage damaged water tanks or pipe, bush fires, spontaneous combustion, riot strikes and vandalism, or falling trees, branches, or objects.

|

Extended policy |

✓ |

❌ |

|

Building structure damage caused by theft |

❌ |

✓ |

❌ |

|

Personal liability coverage |

❌ |

Extended policy |

Extended policy |

|

Medical payments coverage |

❌ |

Extended policy |

Extended policy |

|

Home contents damaged by fire, theft, vandalism, or natural disasters |

❌ |

❌ |

✓ |

|

Loss of personal documents or money |

❌ |

❌ |

✓ |

|

High-value items |

❌ |

❌ |

Extended policy |

Weighing out property insurance costs versus risk

Getting property insurance in Malaysia for your home is an important investment that can help you rebuild your life in the event of a disaster. However, it is important to weigh the property insurance costs versus the risk before deciding.

For example, if you live in a flood-prone area, opting for an extended policy on your chosen property insurance would be worth it. You may also want to consider protecting your home contents from damage or theft if you’re renting or renovating your property.

If you plan to get more than one type of policy, ensuring you don’t have overlapping coverage would be wise to minimise your financial commitment.

With proper consideration, you can choose the property insurance policy that is best for you and your home.

Considering buying a new home? Use our home affordability calculator to find out how much you can afford. If you are satisfied with the terms, you can apply online immediately for a hassle-free experience.

💡 The information provided above is purely for educational purposes.

References

1. Lembaga Hasil Dalam Negeri Malaysia (LHDN). (2023). "Tax Treatment of Premium Paid on Fire Insurance Policy for Building." https://www.hasil.gov.my/

2. iBanding. (2023). "Home Insurance Malaysia Guide: All You Need To Know." https://www.ibanding.com/

3. RinggitPlus. (2023). "Home Insurance Malaysia - The Ultimate Guide." https://ringgitplus.com/

4. PolicyStreet. (2023). "Insurance For Homeowners: The Only Guide You'll Need." https://www.policystreet.com/

5. CompareHero. (2023). "Malaysia Home Insurance – What Is It, And Why Do You Need It?" https://www.comparehero.my/

You may also like

The 2024 Guide to Buying Subsale Property in Malaysia

How to Make the Down Payment for Your New Home with EPF Funds

Related Products

Maybank Home2u

Hassle-free home financing for just about anyone and everyone.

Commodity Murabahah Home Financing-i

A Shariah-compliant home financing facility for all individuals and joint applicants.

Houseowner/Householder Insurance

Comprehensive coverage for the structure of your home and its contents.

Houseowner/Householder Takaful

A comprehensive Shariah-compliant coverage for the structure of your home and its contents.

By

By